|

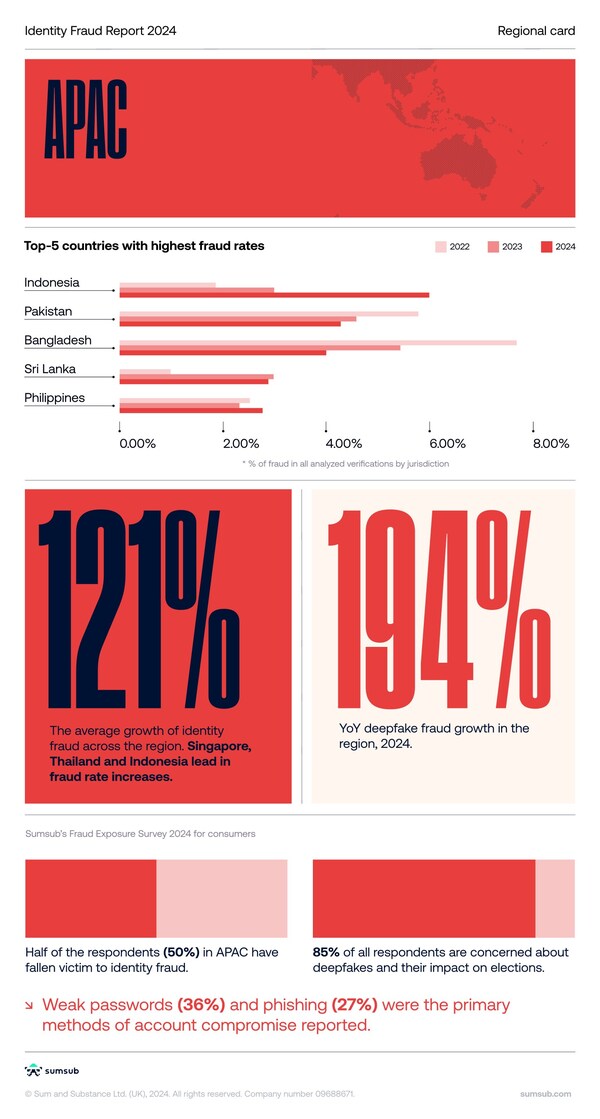

SINGAPORE, Nov. 21, 2024 /PRNewswire/ -- Sumsub, a full-cycle verification platform, released its fourth annual Identity Fraud Report today, highlighting a continued rise in identity fraud across the Asia Pacific region (APAC), driven by increasingly sophisticated fraud tactics and the widespread use of Fraud-as-a-Service (FaaS). According to internal verification data, there was a 121% Year-on-Year (YoY) increase in identity fraud in 2024 across the region, with significant surges recorded in Singapore (207%), Indonesia (205%), and Thailand (201%). Notably, deepfake fraud saw a 194% YoY spike in APAC and increased 4x globally, now making up 7% of all fraud attempts in 2024, from 2023.

"As the digital economy in APAC continues to grow, the evolving nature of fraud presents new challenges that businesses cannot afford to ignore. With tactics becoming more sophisticated and fraud becoming more accessible, the need for enhanced verification measures is more urgent than ever. Robust identity protection is not just a preventive measure but a fundamental part of securing the future of digital businesses and protecting consumers in an increasingly complex landscape," said Penny Chai, Vice President of Business Development, APAC at Sumsub.

Other key findings from the report include:

How Fraud-as-a-Service is Enabling Widespread Cybercrime

The economics of fraud have shifted dramatically, making it more affordable than ever for fraudsters to execute large-scale operations with minimal investment. Today, anyone can access the resources needed to launch fraudulent schemes, regardless of their technical expertise. This shift is largely driven by FaaS platforms and widely available fraud tools, which provide a range of services to facilitate cybercrime, including identity theft, account takeovers, and financial fraud. The scalability offered by FaaS models further amplifies the issue, enabling fraudsters to launch a higher volume of attacks and making it even more difficult for businesses to detect, prevent, and mitigate fraud effectively.

The Growing Complexity of Fraud in the Digital Age

Alongside the rise in mass fraud, there has been a notable increase in more sophisticated, organised fraud schemes. These operations, often involving coordinated fraud networks and money muling, target multiple platforms and industries, and are more difficult to detect and disrupt, leading to significant financial losses for businesses. In Q1 2024, approximately one in every 100 online platform users was associated with a fraud network. In fact, seven of the top-10 jurisdictions for such fraud networks are concentrated in the APAC region, including Thailand, China, Bangladesh, Vietnam, Cambodia, Hong Kong, and Singapore.

Safeguarding the Future of APAC's Digital Economy

As economies across APAC continue to digitalise, the threat of identity fraud will only escalate. The shift towards a digital-first economy presents greater opportunities for fraudsters, making it even more critical for businesses and governments to take proactive measures. Without a robust framework for identity verification and fraud prevention, the rise in cybercrime will continue to undermine the growth of the digital economy and erode consumer trust.

To learn more and download the full Sumsub 2024 Identity Fraud Report, please go to https://sumsub.com/fraud-report-2024/

* Note on Sumsub's research methodology

This study compares identity verification and user activity data from 2023 and 2024, with 2021 and 2022 data also referenced for trend analysis. It is based on aggregated and anonymised statistics from over 3,000,000 fraud attempts across various industries. The research also incorporates insights from a survey of 200+ fraud and risk professionals and 1,000+ end-users. Conducted in August 2024, the survey gathered feedback from companies in sectors like banking, crypto, payments, and e-commerce, along with consumers from 18 countries, to provide a comprehensive view of identity fraud dynamics worldwide.

About Sumsub

Sumsub is a full-cycle verification and ongoing monitoring platform that secures the whole user journey. With Sumsub's customizable KYC, KYB, Transaction Monitoring, Fraud Prevention and Travel Rule solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs, and protect your business.

Sumsub has over 2,500 clients across the fintech, crypto, transportation, trading, e-commerce and gaming industries including Bitpanda, Wirex, Avis, Bybit, Huobi, Kaizen Gaming, and TransferGo.

Comment